the Latest…

An Insider’s Guide to the Best Natural Wine Bars in Paris

April 19, 2024 — On a chilly Saturday afternoon in Paris three weeks ago, I was drinking a deliciously zingy Loire Valley pét-nat, Vins Hodgson Chalan Polan chenin blanc, alongside a scoop of housemade ice cream poached in olive oil….

The World Can’t Get Enough Sauvignon Blanc

March 26, 2024 — Chances are you’ve bought a bottle of sauvignon blanc in the past two weeks. You might have one cooling in your refrigerator, ready for you to open and start sipping. This isn’t just random speculation on my part…

NBA Legend Tony Parker Prepares His First Foray into the Wine World

February 12, 2024 — On a hot day in France’s Provence region last September, former NBA All-Star Tony Parker was picking grapes at Château La Mascaronne intended for its rosé. Then he sat down with the vineyard crew for the regular harvest lunch.

“I felt like a rookie,” he tells me of the experience, as we fork up kale salad and sip the château’s just-released Grande Réserve rosé 2022 at the New York City restaurant Benoit. “I’m hands-on, and I love to be part of that tradition,” he says, adding that he “worked hard enough to realize my back was hurting….”

The Six Biggest Ways Wine Will Change in 2024

January 29, 2024 — As I peer in my crystal glass to puzzle out where the wine world is going next, I see one constant: climate change. It challenged winemakers in 2023, the hottest year in history, and will continue to do so for the foreseeable future.

Wildfires in Greece; massive heat and drought in Spain; and floods, frost, and hail elsewhere in Europe all took their toll last year, resulting in one of the smallest harvests ever. But Napa, subject to wildfires and heat waves in the recent past, escaped with one of the best vintages ever. You could argue that global warming has been good for the UK, as well as fledgling vineyard efforts in Norway and Sweden—places where, in the past, it would have been too cold and rainy to ripen grapes sufficiently….

The Year’s 50 Best Wines Under $50, From an Expert Who Tasted 3,243

December 28, 2023 — I love drinking rare, expensive wine as much as anyone, but I’m a bargain hunter at heart. I’m always on the lookout for the reds, whites, rosés and sparklers that deliver top quality at a reasonable cost. So, as I reviewed my 2023 tasting notes, I was delighted to discover this was a banner year for good values, despite inflation.

I culled my following 50 good buys from 3,243 wines from 21 countries that I sipped this year. I’ve tried to highlight what’s new, at least to me, but some are familiar labels that consistently deliver deliciousness—and they haven’t raised their prices, either. Sadly it gets harder and harder to find Champagnes that sell for $50 and under, but I did…..

The Best Wines, Champagnes to Pour for the Holidays in 2023

December 16, 2023 — Hi again, it’s Elin McCoy, Bloomberg’s wine critic.

The holidays and the end of the year are practically here, and if you’re feeling frazzled with the length of your to-do list, I’m with you. But since I love the generous vibe of this let-there-be-peace season—from the traditional music to the sparkly lights to the chances to pour my best bottles—I’m embracing that list.

During these last few days, I’ve been reviewing my 2023 notebooks to jog my memory of my favorite wines and travels for my Top 10 of the year column and deciding which wine countries should be on my agenda for 2024. Chile and Oregon for sure, and maybe Armenia, along with my usual treks to California, Italy and France….

Wine Critic Elin McCoy: The 10 Best Bottles I Tasted in 2023

December 15, 2023 — Every December, I relive my most memorable wine experiences of the year by flipping through my tasting notes and recalling the bottles that really stood out—and why.

Choosing just 10 is never easy. Great wine is as much about the occasion and the people as the liquid in the glass. In 2023, I was lucky enough to sample incredible reds, whites, rosés and bubblies from 21 countries on six continents, from historic vintages of classic Bordeaux to cabernets from California estates celebrating 50th anniversaries, to luscious examples on visits in Italy, and others from such far flung places as Armenia and China. Close to my heart were the growing number from winemakers seriously committed to fighting climate change….

The Best Wine and Spirits to Give as Gifts for the Holidays

December 4, 2023 — Holiday party season is upon us, and if you aren’t hosting your own (we’ve got you covered there), don’t show up empty-handed to wherever you’re invited. Any one of these easily shared gifts will make you the favorite guest.

Little Rest American Single Malt Whisky

Ten Mile distillery in upstate Wassaic, New York, has created plenty of buzz with its first releases. John Dyson, former deputy mayor of New York City and majority owner of the Williams Selyem Winery in Sonoma, California, purchased this property in 2017 and brought in a a master distiller directly from Scotland. $100

Loco Puro Corazon

The Mexican owner of Napa Valley’s Sullivan Estate is behind this new ultra-premium tequila that pays attention to terroir—where the agave is grown—just as if it were a wine. While Puro Corazon is the top bottling, it also comes in a boxed set with two other options in the family: Loco Blanco and Loco Ambar Reposado. $683….

There’s a Fast, Easy Way to Get Wine to the Perfect Temperature

November 29, 2023 — Consider this: You’re primed to enjoy a superb bottle of wine over dinner, but the red tastes soupy, flat and alcoholic because it’s too warm. Or maybe the white lacks aroma and complexity because you chilled it in the freezer and it’s much too cold. One piece of the puzzle is figuring out the right temperature for the specific bottle you’re pouring; the other is getting and keeping it there. Most iceless tabletop coolers are simply insulators, keeping an already cold bottle cool for a couple of hours. But new, portable electric versions not only maintain the perfect chill for as long as you want, they also get it there in the first place. And quickly. The best is the $495 QelviQ (pronounced kel-vick), which selects the right temperature and cools the bottle two and a half times faster than a refrigerator….

Why You Should Be Drinking the Fashionable Wines of Sicily’s Mount Etna

November 15, 2023 — As grapes were waiting to ripen on Sicily’s Mount Etna in mid-August, the famous volcano erupted, spewing out fiery lava and plumes of smoke. Planes were grounded. Sweepers had to clear ashy grit from the local airport runways.And yet, the explosion didn’t damage the vineyards on Etna’s slopes, unlike the many destructive ones of the past, whose oozing lava flows created the black, rocky-earthy landscape that fascinates today’s tourists and winemakers….

Hail, Heat, Rot in Italy Push France to Top Global Winemaking Spot

October 18, 2023 — Early on a hot, sunny morning in September, I’m nibbling ripe, juicy merlot grapes at the famed Masseto winery in Tuscany’s Bolgheri region as workers unload lush, purple berries. Winemaker Gaia Cinnirella smiles as she samples a grape. “For the most part, I’m very happy,” she says. “The potential for a great wine this year is good. We’re lucky.” The growing season wasn’t easy, with the kind of rain, oppressive humidity and extreme heat Cinnirella has seen only while visiting Asia. In many parts of Italy and France, that combination fostered 2023’s biggest problem: downy mildew, a fungal disease that can spread quickly in vineyards, damaging grapes and drastically reducing yields. Masseto had a team of 80 vineyard workers on alert, checking every vine regularly….

Whether Schmoozing or Just Boozing, There’s a Wine Club for That

September 26, 2023 — Last year, investment banker Carlos Garcia found himself in the steep, rugged Les Manyes vineyard of Spain’s Priorat region, strumming a guitar. The impromptu performance at the Terroir al Limit winery came after a picnic of jamon iberico, olives, local cheeses and rich, red wines, and it was for a small, select group of fellow wine lovers.

They were all part of Vines Global, a private, members-only wine club, and they had spent the morning blending their own lush cuvées under the tutelage of the estate’s celebrated winemaker….

The Waves Is a Natural Wine Club You Didn’t Know You Needed

September 13, 2023 — Sitting on my deck on a recent warm evening, I savored a refreshing, mineral white wine from France’s Loire Valley. I’d never heard of the 2020 Pont Bourceau chenin blanc, a natural wine made by the talented Julien Delrieu, also an avid beekeeper who’s brewed beer with monks in Belgium. But it was bright, tart and savory—perfect for apéro hour.

I wouldn’t have discovered it had it not been for the Waves, a natural wine club that launched online in February. It promises a “personalized shopping experience,” wine details that aren’t pompous or jargony and, most of all, natural wines people will really like….

These Excellent Wines From Burgundy Can Be Had for Less Than $70

July 27, 2023 — Like other Burgundy fans who aren’t billionaires, I’m always trying to discover where the region’s latest affordable gems are hiding.

Four-digit price tags for its most prized pinot noirs and chardonnays are now the norm. One of my favorites, Domaine de la Romanée-Conti La Tâche, will set you back $8,000 a bottle for the current vintage….

New Ranking Lists the World’s 50 Best Vineyards to Visit

July 12. 2023 — A vast blue sky, a backdrop of awe-inspiring snow-covered Andes mountains, and a spectacular pyramid shaped adobe building that looked like a Mayan temple surrounded by vines: that was my first impression of Catena Zapata, one of Argentina’s most famous wineries, on my first visit almost two decades ago.

Winemaker Nicolas Catena put Argentine malbec on the world map. His charismatic daughter Laura now runs the winery, where you can dine in its brand-new restaurant in the vines, play master blender for a day, pair wine with music, or take the ultimate tour to its dramatic Adrianna vineyard at an elevation of 5,000 feet….

There’s More Rosé Wine Than Ever. Here Are the Best to Drink

June 28, 2023 — As the summer season kicked off, I wondered: Has the world has finally reached peak rosé?

“Definitely not,” says Jean-Guillaume Prats, the former chief executive officer of Château Lafite Rothschild. In the past three years, his family and two high-profile partners have acquired three châteaux in Provence, and this spring launched a new global rosé brand, Roseblood. They’ll make 1 million bottles in vintage 2023, and even more next year…

The Best New Hotels, Resorts and Restaurants in Napa and Sonoma

June 22, 2023 — With tourism bouncing back in Napa and Sonoma counties in Northern California, a host of new luxe hotels and fine dining establishments have emerged or reopened. Here’s a list of what you should consider for your next vineyard adventure.

Meadowood Resort

Partly destroyed by the 2020 wildfires, this famed spot in St. Helena reopened late last year with 36 updated cottages and a new casual restaurant. It’s the definition of quiet luxury. For delving deeply into the serious culture of the grape, the new Wine Center can’t be beat. From $1,200 per night….

Tourism in Napa and Sonoma Bounces Back With Posh, Outdoorsy Resorts

June 22, 2023 — Glass of Champagne in hand, I sipped a tiny shot of creamy mussel soup and gazed out over the verdant cabernet vineyard fronting Sonoma’s Cyrus restaurant.

I was in the Bubble Lounge, the first stop on what Cyrus chef Douglas Keane calls a “dining journey.” Next it was on to the kitchen for more bites and a chat with Keane, then to the clean-lined formal dining room for sit-down courses and finally to a dark, hidden space with a chocolate waterfall….

What It’s Like Being a Wine Critic During Bordeaux’s Big Week

May 20, 2023 — Hi readers and wine lovers, it’s Elin McCoy, Bloomberg’s wine critic, again sharing my latest adventures.

I’ve been thinking about Bordeaux ever since I returned from an exciting—and exhausting—two sunny weeks covering the region’s annual spring En Primeur tastings, as I have for more than 20 years for Bloomberg. Thousands of importers and retailers from all over the globe gather to assess the last vintage while the wines are still aging in barrel. I was one of about 100 journalists scouting out the best to recommend to their readers.

Despite the climate-driven weather issues that I wrote about last summer and during harvest, I found many great wines.

The pace is hectic, as everyone tries to taste as many wines as they can in a short space of time and hey, also party hard and share gossip. Bordeaux always supplies plenty of both….

How Do You Pull Out a Tricky Wine Cork? With This Simple, Genius Device

May 19, 2023 — Mature, pricey wines are a treat to taste but stressful to open: Will the inevitably fragile corks crumble? At a recent 23-vintage retrospective of Bordeaux Château Troplong Mondot, Managing Director Aymeric de Gironde pulled corks with the $135 Durand corkscrew to ensure the answer would be no.

As a wine ages, so does the cork, often disintegrating or drying out even if bottles are perfectly stored. Fishing out floating bits is a time-consuming chore, and filtering can affect the taste, not for the better. This scenario inspired Atlanta wine collector Mark Taylor to invent the Durand in 2007. Its patented design has been the standard-bearer for precise pulling of even the most compromised corks ever since….

The 2022 Bordeaux Wine Vintage Is Brilliant — and a Big Surprise

May 19, 2023 — At 9 a.m. on Monday, April 17, I was swirling, sniffing, sipping and spitting a stunning barrel sample of first growth Chateau Mouton Rothschild. It was my first taste of Bordeaux’s 2022 vintage. Over the next two weeks in the region, I sampled impressive wines at dozens of chateaux and official press tastings. Most of them completely upended all my expectations — and everyone else’s.

After all, the 2022 growing season was a drama of non-stop extreme weather: April frosts, June rainstorms, record-breaking heat waves, severe drought and hail….

The Buzziest California Wine Region Isn’t Napa or Sonoma

May , 2023 — If you’re on an all-out quest to make great cabernet, you might aim for Napa or Bordeaux.

Not Daniel Daou. After a decade-long global search for the right plot of land to start growing the grape, he found the ideal combo of soil and climate for his dream in Paso Robles, a land of oak-studded hills and winding back roads, a three-hour drive south of San Francisco. “Paso,” he says, “has a climate between Pauillac in Bordeaux and Oakville in Napa. It was my destiny….”

Champagne Is Outperforming Gold and the S&P 500. Here’s What to Buy

March 29, 2023 — To celebrate romance or toast a great performance, pop open the Champagne, of course. That’s why the 95th Academy Awards featured Brad Pitt’s pink bubbly Fleur de Miraval. But today, along with their sex appeal, the finest bottles also pour out heady investment returns. And as the market bubbled ever higher in 2021 and 2022, speculators pounced.

Here are the kinds of numbers that stirred them up: From January to September 2022, a case of all-Chardonnay 2012 Salon Le Mesnil soared 232%, from £3,800 to £12,600 ($4,670 to $15,485), according to Liv-Ex, the London International Vintners Exchange. The Liv-Ex Champagne 50 Index, which tracks the price performance for recent vintages of a dozen top brands, was a runaway star, outperforming gold, the FTSE, and the S&P 500, as well as the Bordeaux First Growths and even Burgundy….

After SVB Fail, California Winemakers Dodged a Crisis—But Worry for Future

March 14, 2023 — On Friday at 6:30 in the morning, Connor McMahon, owner of Fulldraw Vineyard in Paso Robles, California, went into panic mode over the news of Silicon Valley Bank’s impending collapse.

When the 35-year-old winemaker finally connected with a bank loan officer at 7 a.m., it was too late to move the winery’s money into his SVB checking account so he could open a new account elsewhere. The FDIC had already taken over the bank and shut its systems down. Whatever was in progress—loans and deals—stopped dead….

Moët Hennessy Buys Château Minuty In Big Bet on Luxury Rosé

February 15, 2023 — In winter, I often dream of sipping pale pink rosé in a Provence café while watching sleek yachts bob in a sun-spackled blue sea. I’m not alone on this. And LVMH Moet Hennessy Louis Vuitton SE knows it.

Moët Hennessy, the luxury conglomerate’s wine and spirits division, is announcing its third investment in pink and Provence, a majority share of iconic, family-owned Château Minuty, the rosé leader on the Riviera and in Europe. The company declined to make public the majority percentage and price….

Five Ways Wine Will Change in 2023

January 13, 2023 — Wine news in 2022 was both concerning and upbeat. Once again, scorching heat, record-breaking drought, spring frosts, hailstorms and wildfires reminded vintners of the dire threat and cost of climate change, which will cause more eco-anxiety in 2023. On the positive side, vintners and drinkers are taking sustainability ever more seriously, and more innovations and adaptations are coming.

The first Future Drinks Expo in San Francisco in May was a look at the technology for wine’s future. Robots? They’re in the vineyard already, picking grapes, weeding and pruning, and will soon be working to ferment tiny batches of grapes in the cellar….

Winemakers Champion the Next ‘Perfect Grape’ for Climate Change

January 10, 2023 — Last year you probably tasted your way through any number of well-known wine grape varieties, whether cabernet sauvignon, chardonnay, pinot noir or sauvignon blanc.

In your future, however, are the drinking delights of less familiar names: counoise, vaccarèse, mencía, picpoul blanc and cabernet Pfeffer.

Vintners from California, Texas, Europe and South America are planting or reviving these little-known, sometimes nearly extinct varieties. Part of their aim is to save the world’s viticultural heritage.

But the biggest reason they’re championing these grapes is because they may fare better in a changing climate than popular ones such as temperature-sensitive pinot noir….

Pursuits Weekly: Drink Like It’s the End of 2022

December 24, 2022 — Hi there, it’s Elin McCoy, Bloomberg’s wine critic.

I’m pleased to report I’ve recovered from flipping through my tasting notebooks to pick the most compelling, memorable wines of the year, and zeroing in on those that are bargains. It was intense and time-consuming, but I had fun tasting a few of them again just to be sure.

Now I’m ready to party, and am fixated on my favorite end-of-year topic: what to pour for the holidays….

The Top 10 Wines of 2022, From $35 to $35,000

December 15, 2022 — At the end of the year, I flip through my tasting notebooks with nostalgia, recalling all the wonderful wines I’ve sampled. Singling out the most memorable for my top 10 is never simple. I was lucky enough to taste brilliant wines from 21 countries in 2022, including retrospectives of the California cabernets and chardonnays from estates celebrating 50th and 60th anniversaries, as well as plenty of legendary classics from Bordeaux, Burgundy, Champagne, Portugal and Australia.

In the mix were reds, whites, rosés and bubblies from lesser-known regions and grapes (completer, petite arvine, areni noir), and many from wineries firmly committed to a green wine future, which looms more important than ever……

The 50 Best Wines Under $50 Right Now, From Alto Adige to New Zealand

December 2, 2022 — My idea of a yearend report means scrolling through all my tasting notes for the wines I would be happy to drink again—and that deliver quality at a seriously reasonable price.

This year, I found more good-value vino than ever while sampling 2,481—yes, I double-checked—red, white, rosé, orange and sparkling examples from Armenia to Uruguay….

American Gaylon Lawrence Buys Grand Cru Bordeaux Wine Estate

November 1, 2022 —

Gaylon Lawrence, a Tennessee-based billionaire with US farming and banking interests, has been on a wine-buying spree ever since purchasing his first property just four years ago. After snapping up Napa Valley’s iconic Heitz Cellar in April 2018, he grabbed the historic Haynes vineyard in Napa’s Coombsville area and added the equally historic Burgess Cellars and Stony Hill Vineyard.

Now, Lawrence and Carlton McCoy Jr., managing partner for Lawrence Wine Estates, are taking on Bordeaux. On Oct. 31 they announced the purchase of a majority stake in Château Lascombes, a second growth estate in the Margaux appellation with a picturesque but slightly run-down ivy-covered stone chateau. It produces about 20,000 cases a year of a red blend that includes Cabernet Sauvignon and Merlot with a dash of petit Verdot. For an undisclosed price, they purchased the chateau, about 300 acres of vineyards—and an underperforming reputation they aim to change….

Bigger Is Better as Sales of Large-Format Magnums, Methusalehs Soar

October 21, 2022 — Everyone likes a spectacle—even wine connoisseurs.

When Philippe Newlin, now the Bordeaux buyer for wine.com, got married, he wowed his 80 guests by pouring glasses of crus classés Bordeaux from Methusalehs, or 6-liter bottles. Each one held the same amount as eight regular bottles of Bordeaux and stood nearly 2 feet high. The couple’s best friends wrote celebratory inscriptions with gold metallic markers on the glass, making the impressive empties treasured souvenirs…..

How the Visionary Class of ’72 Created California’s Wine Wonderland

September 22, 2022 — For Northern California wine country, 1972 was a year like no other.

That was when Denver entrepreneur Ray Duncan and winemaker Justin Meyer, who’d just left the Christian Brothers religious community, produced 1,100 cases of the first Silver Oak cabernet in Napa, bottling them in an old dairy barn…..

Pursuits Weekly: The Drama, Heartbreak, and Hope of Wine Harvest

September 24, 2022 —

Hi, I’m Elin McCoy, the wine critic for Bloomberg for the past two decades, during which I’ve enjoyed way more than my fair share of the world’s great wines.

But don’t think I just sit around sniffing and sipping (and spitting).

I go everywhere wine is grown and made and right now, my mind is on harvest. It’s my favorite season because its weeks of drama are all about hope and a new chance to make something great—but also about loss and heartbreak. That puts it on par with opera, one of my other loves.

Despite this year’s disasters (spring frost, extreme heat, drought, hailstorms, and wildfires) last-minute rainfall saved the day for some, while others are celebrating luscious grapes that will make stunning wines. Success always depends on chance, location, timing, skill. You can read all about how regions in Europe and the US fared in my 2022 harvest report….

Heat and Drought Cause ‘Earliest Ever’ Wine Harvest, But Hope Remains

September 19, 2022 — In Portugal’s Douro Valley, the team at the Quinta do Vesuvio winery was stomping picked grapes in ancient stone lagares (troughs) in August. “Never in the history of this great estate, which dates to 1565, have grapes been trodden this early,” says Harry Symington, whose family has been producing premium ports in the Douro for five generations.

The nail-biting tale of the 2022 harvest—scorching heat and record-breaking drought that sped up ripening in vineyards from Germany to Paso Robles, Calif.—is another reminder of the power of climate change to upend the wine world.

Still, many winemakers are bullish. Drought causes smaller grapes with more concentration and deters diseases such as mildew. Winemakers in some regions, such as Champagne, talk of a great vintage….

A New Mexico Winery Breaks All the Rules on Bubbly

August 23, 2022

Two unusual American sparkling wines debuted this month. The surprise? They were made by a winery near the Rio Grande in Albuquerque, New Mexico—land of adobe architecture, high deserts, and chiles-laden cuisine.

The bubblies are part of a recent boundary-breaking project, Vara Winery & Distillery. Its team of all-star winemakers, distillers, and chefs create everything from wines to vermouth, gin, and rum. A new Santa Fe tasting room, Vara Vinoteca, opens this summer….

The 10 Best Ways to Get Quality Wines Delivered to Your Door

August 4, 2022 — Remember how those regular monthly home deliveries of wines during the pandemic felt so essential? When all the out-of-work sommeliers, deserted restaurants, and retail shops bereft of browsers were struggling to survive, they started new-style wine clubs.

Places such as Manhattan’s tiny King restaurant and Michelin-starred Cote plundered their cellars to ship boxes of curated wines to customers, while sommeliers used their connections to ferret out such hard-to-obtain niche bottles as Italian orange wine Partida Creus….

Record Temperatures, Wildfires Wreak Havoc on Europe’s Winemakers

July 26, 2022 —

In Portugal’s Douro Valley on July 7, a wildfire burned close to Oscar Quevedo’s Quinta da Alegria vineyard. By the middle of the night, flames surrounded it. The vines around the edges, amounting to about a hectare, burned. In his 39 years, Quevedo says, “I had never seen such a big and fast fire in the heart of the Douro.”

All over Europe, temperatures in wine regions have been sweltering at new highs, and heat waves are moving north into such normally cool countries as Germany. In the UK, temperatures above 40C (104F) were recorded for the first time. Winemakers worry this will lower yields by 25% or more for this vintage. Many had already been slammed by early frost and hail. Increasingly intense heat waves are signaling that conditions could become even more extreme and unpredictable over time….

Never Bring White Wine to a Cookout, and Other Summer Grilling Rules

July 12, 2022 — For seasonal food and wine perfection, few things can top a cookout. My favorite grill experience was at a tiny remote cottage with no electricity in Uruguay, the vacation retreat of Argentine celeb chef Francis Mallmann, who popularized traditional open-flame techniques internationally.

Everything we ate was cooked on a hand-forged grill over a sparking fire surrounded by stones. Under a dark sky sprinkled with stars, at a table lit by candles of all sizes, we savored thick-crusted, sizzling steaks with tiny grilled potatoes and accompaniments all kissed with char. Later, Mallmann read from poetry books pulled from piles stacked precariously around the house. Naturally, there were reds and whites to match the mood, the weather, the food, the poems….

London’s Plush Private Wine Club Embraces Digital—and Takes on the World

July 2, 2022 — The first time I visited 67 Pall Mall in London, it was more noisy construction site than upscale wine club. Standing in the middle of rubble, founder Grant Ashton sketched out his vision of an unstuffy place for oenophiles to sip and socialize: a cellar with thousands of wines, dark-paneled eating and meeting spaces, reasonable prices, and member wine storage in a former “invincible” bank vault. I wondered it if would ever open.

When it did, in October 2015, I still doubted the club would succeed in a city brimming with great restaurants and wine bars. I was wrong…

So, How Was the 2021 Vintage in Bordeaux?

June 15, 2022 — OK, no one in Bordeaux is proclaiming that 2021 is “the vintage of the century,” the typical spin the French trot out for top years such as 2009 and 2010, or the recent trilogy of 2018, 2019, and 2020.

There’s a reason. Climate change hammered the region last year with devastating frosts, double the average amount of rain at the wrong times, mildew, black rot, insect infestations, lack of sunshine, even hail.

“2021 was probably the most challenging growing season of the past 30 years,” says Emmanuel Cruse of Château d’Issan, which experienced much of the above but escaped hail.

Now futures prices for the wines, still quietly aging in barrel, are starting to trickle out from retailers. The idea of futures is to buy at the very lowest price by putting money down for wine still in barrel, then receive bottles of it in a couple of years, when, presumably, it will cost more. That doesn’t always happen….

Pink Wine Season Is Upon Us: The 10 Best New Rosé Bottles, Rated

May 24, 2022 — When the temperature soars and the sun is shining at 7 p.m., you know rosé days are underway again.

What people call the “happy wine” has always been something to sip without taking it, or yourself, too seriously. Rosé is about embracing fun, the beach, day-drinking, and personal style, which is surely why we all guzzled it during the doom and gloom of a pandemic that isn’t over yet.

Get ready. As more wineries rush to cash in on the popularity of pink, styles are expanding. This year brings a wave of new-spin versions worth sipping; some others are, predictably, more marketing hype than taste….

A Luxembourg Prince Is Emptying His Private Wine Cellar for Charity

May 13, 2022 — On Saturday, May 21, an extraordinary personal cellar of old and newer vintages is going on sale at Sotheby’s in New York. The more than 4,200 bottles come from Prince Robert of Luxembourg, owner of Bordeaux first growth Château Haut-Brion, his family, and his friends.

Just perusing the catalogue will stimulate the fantasies of wine collectors. The sale includes some of the most unique, priceless vino on the planet, all with perfect provenance—and you can feel virtuous no matter how many bucks you drop on any of the 818 lots. It’s being called one of the biggest charity auctions of its kind ever staged….

Don’t Pop That Cypto-Cork Just Yet on Wine NFTs

April 25, 2022 — Pricey Fleur de Miraval rosé Champagne is Brad Pitt’s latest wine baby. The second release (ER2) was poured at this year’s Oscars, and in a few months, Pitt’s Champagne house plans to join the cryptocurrency world craze to drop its first NFTs.

Non-fungible tokens, or NFTs, are smart contracts tied to digital (sometimes physical) goods by way of a QR code that’s all recorded on a blockchain. Exactly what goodies these might include hasn’t yet been revealed, but what about an exclusive cuvée and one-on-one bubbly tasting with Brad at his fabulous estate in Provence…?

No, You Don’t Need a Different Glass for Every Kind of Wine

April 6, 2022 — There are many things I love about wine: the rich color of a lush Napa Cabernet, the grassy aromas of a bright sauvignon blanc, the texture of fizzing bubbles in Champagne. The bonus? The bonus? The only equipment you need to appreciate such sensory delights are a nose, a mouth—and a glass…..

It’s a Golden Era for Sparkling Wine. Here Are 11 Surprising Bottles to Try

March 14, 2022 — A daily glass of fizz sustained me during the darkest days of the pandemic. Like so many other wine lovers, I find there’s something about bubbles in wine that makes everything look a little brighter, a little more hopeful—no matter what dire things are happening in the world….

Hamptons Rosé Master Wolffer Will Make Pink Wine From Provence, Too

February 4, 2022 — It was a big deal in 1992 when German-born international entrepreneur Christian Wolffer gambled on making dry, elegant, Provence-style rosé from his vineyard in a Hamptons potato field. Back then, the pink vino grabbing American attention was sweet white zinfandel.

But as rosé became the drink that defines summer, his bold move turned out to be more than prescient. By 2020, the Wolffer Estate winery was selling eight different pink cuvées, including sparkling, no-alcohol, and even rosé cider.

You might think that’s enough for any one winery. You would be wrong….

It’s Sauvignon Blanc’s Moment. Here are Eight Under $30 to Try

February 1, 2022 — Sauvignon blanc is my go-to white. Maybe yours, too. It was the fastest growing wine variety in the U.S. in 2020 as sales soared 22% in volume, 24% in value.

Why is the grape getting so much love? I think wines made from it have a winning formula. They’re dry and crisp, with a light touch yet high flavor, and they boast tongue-tingling notes of lemon and herbs. There’s also that whip-cracking acidity. Think of them as the ultimate food-friendly, all-purpose vino you can happily pair with just about everything except red meat. The hallmark taste is immediately recognizable. A chilled glass before dinner calls up sunny days and lively music, giving the day an upgrade even if it’s been a downer….

For Wine This Year Expect a Champagne Shortage, NFT Surplus

January 10, 2022 — Last year brought both good and bad news to the wine world. Happily, the U.S. lifted tariffs on European bottles, drinkers cautiously returned to tasting rooms and restaurants, and we all continued to buy wine online with gusto.

On the downside, extreme weather—floods, fires, frost, hail, and scorching heat— devastated many of Europe’s wine regions, reminding us that the effects of climate change in 2022 will be unpredictable at best….

The 10 Most Memorable Wines That I Drank This Year

December 23, 2021 — Picking my Top 10 experiences of 2021 wasn’t easy: I sampled great wines from 18 countries on six continents this year.

Flipping through my tasting notebooks revealed stars for dozens of wines, including great vintages of Bordeaux, memorable California cabernets and chardonnays, and brand-new, stellar cuvées from Champagne, both fizzy and not….

December 9, 2021 — It’s time again for my annual report on the wines I’ve tasted over the past year that deliver top value as well as sheer deliciousnes

Happily, while sampling 2,705 (yes, I checked that count) red, white, rosé, orange, and sparkling examples, I found more great vino at a reasonable price than ever. And that’s despite the pandemic, recent extreme weather that decimated crops and reduced quantity, and this year’s logistical problems including a glass bottle shortage and shipping delays!

So where to look for 2021’s best buys..?

What is Vegan Wine? An Essential Guide for Plant-Based Menu Planning

November 18, 2021 —

Outspoken Italian winery owner Sebastiano Cossia Castiglioni is a wine pioneer in the plant-based food movement. He turned vegetarian at age 15, eventually went fully vegan, and more than a decade ago extended that commitment to Querciabella, his now-organic and biodynamic Chianti Classico family estate.

“I didn’t want to be part of the way conventional agriculture devastates the environment and abuses animals,” he says. “We removed all animal products from every aspect of our winemaking process, including the vineyards. You don’t need them to make great wine.” The proof is in his reds and pricy white, which have steadily become livelier, more vibrant, and more intense…

Clothing Brand Patagonia Is Now Making Wines. Are They Any Good?

October 25, 2021 —

I won’t keep you in suspense. The wines and other fermented beverages that Earth-friendly clothing company Patagonia is releasing today will surprise you—and in a very good way.

They include a juicy red from the hybrid marquette grapes made at a permaculture farm in New York state, a tangy Austrian pinot blanc infused with thyme, a refreshing apple-and-quince Chilean cider, and a light-bodied red from Mt. Etna….

Businessweek

The Hectic Day in the Life of a Napa Winemaker During Harvest

There’s a lot riding the choices of grape guru Steve Matthiasson, who oversees 27 vineyards both for his own wines and high-profile clients

Businessweek

After Awful Year, a Small But Mighty Wine Vintage Is Expected

Mildew, drought, frost, hail—climate change wreaked havoc on almost all wine regions in 2021. But those few grapes that made it through bear the mark of a memorable vintage.

Wine

‘Things Change Because You Do Things,’ Says Napa’s Only Black Wine CEO

Carlton McCoy, the former wine director of Aspen’s Little Nell, talks about how he has transitioned to running Heitz, an historic cellar.

The One

A $700 California-Australia Wine Blend Aims for Icon Status

Mixing top grapes across hemispheres, this wine makes a bold bid for investment potential.

Wine

Rosé Wine Has a Dark Side. Here’s Why You Should Embrace It

These more intense, more complex bottles pair well with food and make for quality year-round drinking.

The Top Eight Places to Taste Wine in California Right Now

Garden lounges for sipping, $950 cabernet flights, even barrel rolls in a biplane: The newest oenophile experiences are deluxe—and cost a pretty penny.

Champagne With No Bubbles? Thank Climate Change

Still wines from the legendary home of sparklers are becoming more commonplace, and rising temperatures are part of the math that makes them possible.

from Bloomberg:

Bordeaux 2020: The 19 Wines to Buy from the Strangest Vintage Ever

Château Margaux, $620 a bottle; Château Lafite Rothschild, $695; Haut-Bailly, $139; Ducru-Beaucaillou, $239 . . .

The final futures prices for the 2020 Bordeaux wines trickled out this week, meaning we’re nearly at the end of the wine world’s most important spring ritual: en primeur.

Over the past two months, the world’s retailers and critics, including me, have tasted samples of the wines still aging in barrels, and châteaux have very slowly rolled out what they’ll cost.

All that’s left is for consumers to buy. Should you?

Well, after tasting more than 350 barrel samples this spring, I offer a qualified yes….

It’s Time to Stop Laughing Off Wines With Funny Names

June 14, 2021 —Yetti & the Kokonut B’Rosé? Wildman Piggy Pop Pet Nat? When I spotted these Australian wines in a shop, I started laughing. The names were cute, but I wasn’t ready to take the wine itself seriously. My rule of thumb has long been that if a wine has to use a funny name to get you to grab it, the liquid inside the bottle probably doesn’t have much to say for itself. Think Mad Housewife, Broke Ass, Fat Bastard, and the like.

But Ronnie Sanders of VS Imports, who brings the Yetti and Wildman wines to America, says both are so popular he can barely keep them in stock.

They’re part of a new wave of wines with tongue-in-cheek names that range from silly to punny to in-your-face sexist. But the point isn’t to cover up for weakness in the wine. Edgy winemakers are using the names to signal how different their wines are from traditional estates’ conventional vino.

The trend is booming. The surprise is how delicious the juice inside the bottles can be…..

The Top Rosés for Summer Come With Bubbles, in Cans, and Even Boxed

May 28, 2021 — You can’t escape rosé this year. But why would you want to? It’s inspiring everything from street festivals to lingerie labeled “rosé” instead of pink. The wines are now in cans, boxes, and fancy glass bottles that look as if they hold perfume.

Some have bubbles, most don’t. Others come as ready-to-drink rosé spritzers or seltzers, or no-alcohol pink wines infused with hemp. Oh, and they’re made of grape varieties that span aglianico to zinfandel.

Even London’s Covent Garden district is in the clutch of blush fever. Its first ever Rosé Festival opened on May 17 and will last through June 6. What’s on offer? Ice-cold rosé cocktails, rose petal infused prosecco, frozen rosé, and cute bicycle carts peddling rosé in cans, the summer’s hottest pink wine wrinkle….

Fighting Environmental Degradation, One Bottle of Fancy Mezcal at a Time

Photographer: James Wright

May 19, 2021 — When explorer and eco-activist David de Rothschild first encountered mezcal in a San Francisco bar 15 years ago, he fell for the smoky taste it brought to a cocktail. At the time, he was deep into building his Plastiki project, a 60-foot sustainable catamaran made with 12,500 reclaimed plastic bottles stuck together with a glue that included cashew nuts and sugar. He and his crew sailed it thousands of miles across the Pacific to raise awareness about the billions of pounds of plastic poured into the ocean each year.

On the journey, the taste of mezcal stayed in his memory.

De Rothschild’s first try at mezcal was in 2015. It debuted only in California as a tiny part of a now-closed wellness, clothing, and skin care company he called the Lost Explorer.

Now he’s gone all in, launching three luxury (read: expensive) versions of this Mexican spirit under the Lost Explorer label, and he appears on my computer screen from London to discuss them. Though he sports a modern orange beanie, his scruffy locks and full beard give him a 19th century Gold Rush prospector look, updated with a serious explorer-style watch.

With mezcal, he’s hunting a different kind of gold, a spirit that can tell a story about the issues he considers most important: sustainability, biodiversity, curiosity, community, and ultimately, saving the planet….

PursuitsPosh French Winemakers Pounce on Big American Vineyard Selloff

European vintners are finding toeholds in the U.S. just as some of America’s oldest wineries are ready to cash in

PursuitsThese Elite Bottles of Wine Are So Exclusive, You Can’t Just Buy Them

Certain rare bottlings from big-name wineries are available only to members of clubs or to people who show up and know to ask. Here are some worth hunting down—and a pro tip: Be nice.

The Best Wines Under $25 That Taste As If They Cost Twice That

March 18, 2021 — One freezing night last month, I sipped several red blends alongside a spicy beef stew studded with olives. The price of the best-tasting bottle—$7—stunned me, but its source didn’t: Portugal.

I’m addicted to tracking down wine bargains (maybe you are, too) and this European country is my new hot spot for exciting, wildly underpriced reds and whites that have authentic character. What’s not to like about fresh, savory whites and delicious, plush-textured reds made by talented winemakers from more than 250 exotic native grape varieties? And that value?

No wonder sales of Portugal’s wines are on a roll…

Pink Prosecco Is the Fizz That’s Poised to Ride the Rosé Wave

February 10, 2021 — What could be more romantic for Valentine’s Day than a glass of pale pink, easy drinking, sparkling wine? Even better, one that costs less than $20 a bottle?

Vintners in the northern Italian prosecco region are banking on the combo of ever popular rosé and prosecco—which, over the past decade has gone from niche product to a half-billion bottles in sales annually—to become a “lifestyle symbol” that recalls hanging out at Venetian wine bars and sunning on La Dolce Vita beaches.

But the story behind this new pink boom is more complicated. Although the most luscious examples are fresh, bright, and satisfying enough for love-forever toasts, not all are worth pouring on V-Day—or any day—even at cheap prices. Big U.S. brands are trying to cash in by bottling Italian rosé prosecco under their own labels, but most don’t have the same light stylishness of those from Italian vintners.

That’s my takeaway from a blind tasting of more than 20 examples available so far….

Start Your Own Wine Collection With These Bottles and Services

February 12, 2021 —

Maybe last year you wished for a cellar of great wines to see you through the pandemic because, well, having wines on hand to drink is certainly one benefit of collecting.

But here’s another. “With interest rates near zero, a wine collection is an investment, a steady, safe haven for capital,” says Miles Davis, head of the professional portfolio management service for the U.K. platform Wine Owners.

He’s thinking about numbers like this: Since its first release, the value of a case of 2000 Armand Rousseau Chambertin, a grand cru Burgundy, has soared 3,002% to its current market price of $38,553 (as of Feb. 5), according to Liv-ex, the global marketplace for the wine trade.

In 2021 it’s easier than ever to play this collecting-investing game, for pleasure or profit—or both….

Eight Ways Wine Will Change in 2021

December 28, 2020 —- Where to start? Covid-19 upended all our oenophile habits, shifting how we buy wine (online more than ever), how we taste and learn about it (virtually), and where we end up drinking it. (Not at parties, bars, and restaurants.)

Thankfully, many cities considered wine shops to be essential businesses. Vino has been a great connector this year, as we’ve shared glasses with friends virtually and traveled by proxy to regions we can’t visit.

Surprisingly, the pandemic didn’t shift what we put in our glasses all that much. Rosé is still hot. So is hard seltzer, which, along with canned cocktails (both, ugh!), grew 43% during 2020. Bubbly is still going strong, with more countries than ever producing great examples (read: Brazil).

The earliest harvest ever in Burgundy and devastating fires in California wine country for the fourth year in a row reminded people that climate change is a truly serious issue, and inspired new wine initiatives to save the planet.

Expect many of 2020’s trends to evolve in 2021—the health and wellness alcohol-free drinks boom, the canned and boxed wine movement, vino from extreme regions—helped along by new digital and AI technology innovations, even if everyone really dreams of returning to sharing wine with others outside their homes.

Here’s what else I see in my crystal glass….

The 50 Best Wines Under $50https://www.bloomberg.com/news/articles/2020-12-07/best-wines-under-50-champagne-ros-red-white-natural-and-organic?srnd=pursuits-vp

December 7, 2020 — Picking my annual 50 under $50 list was extremely difficult this year. There are more delicious value wines than ever from around the globe. And I should know: I sampled a couple thousand of them in 2020.

You can now find bargain bubbly from everywhere, including Greece, California, and South Africa. My fizz surprise of the year was the quality of bottles from Brazil. Add in the ever-expanding number of pétillant naturel wines now available, and you could enjoy a different—and good—fizz each day of the year. Experiment!

Sadly, it’s still difficult to find great Champagnes that cost less than $50 a bottle. Best bets, as always, are entry-level, nonvintage sparklers from the best big houses and especially from up-and-coming grower-producers.

The rules for finding the top red, white, and rosé values haven’t changed much. Riesling from everywhere is still undervalued as are wines made from esoteric grapes. Examples with turbiana (white) as well as parpato and susumaniello (both red) made my list this year….

Toast Your Thanksgiving With a Rosé from Texas or a Vermont Red

November 19, 2020 —

This year will be my Zoom Thanksgiving, and maybe yours, too.

The idea of feasting virtually with family and friends—and the divisive election—makes me want to vote for community and unity on this all-American holiday when it comes to wine.

My solution? Embracing our country’s grand diversity by turning to bottles from across the country, made by winemakers who reflect the American dream.

All 50 states produce wine in some form or fashion—yes, even Florida, Alaska, and Hawaii—though California still accounts for over 80 percent of the nation’s bottles. No longer up and coming, Washington state has more than 1,000 wineries, and Oregon only slightly fewer. There are 470 in New York state alone.

You can find exciting reds, whites, and rosés from Michigan, New Mexico, Texas, Virginia, and even chilly Vermont, where The Old Farmers Almanac predicts snow next week….

Brazil’s Under-the-Radar Sparkling Wine Is a Big Bargain, Too

November 13, 2020 — True story: When former Brazilian President Luiz Inácio Lula da Silva served France’s Nicolas Sarkozy a glass of Casa Valduga’s Brazilian sparkling wine, Sarkozy complimented his choice of Champagne. (Awkward.)

The seductions of Serra Gaúcha, the southern wine region where it was made, are pure Brazil—parrots and waterfalls, soccer matches, tangy caipirinhas, sizzling churrasco—but with this big surprise. It’s an oasis of bright, vivacious, festive bubbly, with chardonnay playing a starring role.

You can be forgiven if you didn’t know this. But here’s one trick to spotting the next hot wine countries: Check the authoritative The World Atlas of Wine. For the first time, the latest edition allots an entire page to Brazil.

I got my first serious taste of the country’s wines several years ago at a South American wine conference. The diversity of fizz styles was impressive. Whether inexpensive, chuggable, prosecco-style sparklers, sweet frizzante moscatos, value-driven bruts, or sophisticated vintage blanc de blancs, Brazil had it covered. Best of all, more of them are now available outside the country….

from Businessweek

Presidential Politics and Wine Can Make for an Awkward Pairing

November 3, 2020 — President Rutherford B. Hayes had embraced the temperance movement in his election bid, but at his first White House event in 1877, his advisers begged him to avert a diplomatic disaster and serve wine. The dinner was for Grand Duke Alexis, the Russian czar’s son who’d enjoyed Champagne while hunting with Buffalo Bill Cody on a previous U.S. visit.

Theodore Roosevelt, however, was all too willing to accept free Champagne from Moët & Chandon for a state dinner in 1902 honoring Prince Henry of Prussia and to launch the imperial yacht. The only problem? The prince’s brother, the kaiser, had supplied a German sparkling wine and was not pleased.

Politics and wine can make for clumsy pairings, as detailed by the lavishly illustrated and strictly bipartisan Wine and the White House: A History ($55). Written by Frederick Ryan Jr., chairman of the White House Historical Association, the book delves widely, though not deeply, into how presidents have chosen to highlight ceremonies, foster diplomacy, and heavily promote the American wine industry long before the world viewed the U.S. as a serious producer….

from Bloomberg News

Organic Winemaking Is a Zoo With Armadillos, Falcons, and Pigs

October 12, 2020 — At Tablas Creek winery in Paso Robles, Calif., 200 black-faced Dorper sheep munch weeds among rows of vines. Along the way, they fertilize the soil while donkeys and 200-pound Spanish mastiffs ward off coyotes and mountain lions.

Pairs of owls zoom from vineyard boxes to eliminate more than 500 vine root-eating gophers a year. Chickens scratch the earth, scarfing up unwelcome bugs.

A couple of decades ago, this vineyard menagerie would have been highly unusual. Now, the commitment to organic and biodynamic viticulture has pushed top wineries across the globe to look to nature for alternatives to chemicals. Furry, feathered, scaly, and four-legged animals (even bats) have become essential winery employees, contributing to vineyards’ overall health by replacing toxic pesticides and herbicides.

Tablas Creek goes even further. It’s the first winery in the world to obtain regenerative organic certification, a new international farming standard intended to combat climate change….

Napa’s Worst Case Scenario: 80% of Cabernet Lost to Fire, Smoke

October 6, 2020 – On the evening of Sept. 27, when winemaker Chris Howell saw flames on a ridge a mile away from Cain Vineyard and Winery, he and his wife Katie Lazar knew they had to leave.

A few hours later, Cain was engulfed by the region’s latest blaze, the Glass Fire, which has since metastasized into a group of fires known as the Glass Fire Incident. Wind-propelled flames and smoke billowed up from the canyon, between the two ridges, and moved over from the Sonoma side of the mountain. It destroyed Cain’s winery, an historic 1871 barn, barrels of the highly regarded 2019 vintage that was aging in the cellar, as well as all of his new wine harvested this year….

Lebanon Needs You to Buy Its Wines. And, Yes, They’re Really Good

September 24, 2020 — Massive explosions rocked Beirut’s huge port last month, killing more than 200 people. The owners of Château Marsyas winery were injured in their commercial office just 600 meters away and crawled through debris from fallen walls and ceilings to escape. Two weeks later, they were harvesting grapes at their vineyards in Lebanon’s Bekaa Valley.

That’s the kind of resilience winemakers have in this tiny country on the eastern Mediterranean coast, squeezed between Israel and Syria.

The blast was the latest catastrophe in a year of multiple disasters: social unrest, a political crisis, economic collapse, and a Covid-19 lockdown. The value of the Lebanese pound sank 80%.

Because of currency devaluation, explains Marc Hochar, whose family owns the country’s most famous estate, Château Musar, wineries can’t increase local prices enough to cover the higher prices they must now pay to import bottles, labels, corks, tractors, and more—and they can’t take money out of banks.

“Exports,” says Elie Maamari of Château Ksara, a big winery, during a tasting over Zoom, “are our salvation.”

Will these disasters, just the latest in this country’s 6,000-year winemaking history, grab the world’s attention and translate into sales of its reds, whites, and rosés?

I hope so….

Around the World, the 2020 Wine Harves

t May Be Most Troubled Ever

September 15, 2020 — In Burgundy, starting in mid-August, masked workers fanned out into vineyards, carefully socially distanced, to begin picking grapes. It was the beginning of one of the earliest harvests of the past 650 years, and it is now ending.

The 2020 harvest looks pretty different in many places around the world, much of it due to climate change: scorching heat and deadly wildfires in California’s Napa and Sonoma; drought and heat waves in France; thunderstorms and tornadoes in Italy.

Add in worry over the global economic malaise, and the 2020 harvest is shaping up to be one of the most troublesome in memory. Covid-19 closed tasting rooms and restaurants. The 25% tariffs the U.S. imposed on English, French, Spanish, and German wines caused exports to drop dramatically, and the tariffs, sadly, will remain in place for the foreseeable future.

As a result, European cellars are full of unsold wine. While 2020’s generous crop is welcome in regions such as Burgundy, the government in Spain is paying farmers to reduce yields through green harvesting, or thinning the number of grape bunches on vines. (The compensation can be up to 60% of the usual price of lost grapes.)

With so much unsold wine clogging up their wineries, some vintners don’t have enough space to age the wine from this year’s generous crop. To make room, some are selling excess stocks in bulk to distilleries at a deep discount to be turned into—ouch—hand sanitizer and perfume.

So how is this trouble-plagued harvest going to turn out…?

California’s Wildfires Came at the Worst Time for Wine Industry

August 27, 2020 — Vineyard owners in California’s Napa and Sonoma regions and the Santa Cruz Mountains had planned to harvest grapes over the next few weeks. But with flames threatening wineries and homes, thousands of people have had to evacuate, although some winemakers and winery workers stayed to help fight the fires alongside Cal Fire, the state Department of Forestry and Fire Protection.

It’s hard to grasp the extent of devastation. On Wednesday morning, Aug. 26, Cal Fire reported that in the prior eight days, the LNU Lightning Complex fire engulfing Napa, Lake, Sonoma, Solano, and Yolo counties had burned 357,046 acres, destroyed 978 structures, damaged an additional 256, and killed five people. One part, the Hennessey Fire in Napa and Lake counties, had accounted for 299,763 acres and was only 33% contained. In Sonoma, the component Walbridge fire had burned 54,923 acres and is only 19% contained. Down in the Santa Cruz Mountains, a separate conflagration, the CZU August Lightning Fire, had burned nearly 79,000 acres burned and destroyed 330 structures.

And that’s just in northern California. In the entire state, one of the biggest fires ever encompasses 700 blazes that have already burned more than 1.3 million acres—an area bigger than the state of Delaware….

Forget French Rosé, Italy’s Under-Explored Pink Wines Offer Big Value

August 18, 2020 — For the past month, I’ve been dreaming of Italy and the summer trip that never happened. Past memories of beaches with views of the blue Mediterranean, winding paths to hike in the Dolomites, and trabocchi fishing platforms in the Adriatic Sea, where you can dine as the sun sets, play like a film loop in my fantasies. Not to mention the freshly made pasta, the espresso, the gelato, the truffles, and, of course, the vino.

So this August, I’m taking my much-longed for visit via a tour through the country’s little-known rosatos, or pink wines, which are produced in some of Italy’s most beautiful places. Members of a new movement, Rosautoctono, want to chart its future as high-quality wine made from native grapes and to remind people that it has a long history as an everyday wine. They’re pushing the term “rosa” to describe the country’s best pink wines, though so far, only a few wineries are putting it on the label.

Italy’s rosas offer a wider range of hues than do French rosés, from pale salmon to an intense, dark-cherry pink. Taste diversity runs from light and bright to soft, round, and fruity and even bold, rich, and full-bodied. They brim with savory, cherry, and herb flavors that will still be delicious on the table long after Labor Day….

from Club Oenologique

Can a rosé ever be worth £100 a bottle?

August 11. 2020 — This summer as any summer, Saint Tropez means beautiful people sipping pink wine with a view of the blue Mediterranean. Whether from glamorous yachts or exclusive beach clubs, the only difference is that there is a little more social distance between them. And, perhaps, something new in their glasses.

Top of the list of elegant and expensive pours for 2020 is Domaines Ott Etoile, a seductive, silky-textured, pale salmon-colored rosé from Provence that debuted a couple of months ago. The price? £120 for one sleek, curvy bottle (at retail – you can double or triple that in the beach clubs).

Etoile is just one of the new “prestige” rosé wines costing big bucks. In 2018, the Cannes Film Festival was the launch pad for the organic Muse de Miraval from Brad Pitt and Angelina Jolie’s Provence estate, Château Miraval. It’s available only in magnums, at £250+ , and intended to be aged like a cru classé….

from Decanter

August 2, 2020 — This spring, as the coronavirus pandemic swamped the world, sales of wine in America skyrocketed. In April, San Francisco-based online retailer Wine.com was shipping 50,000 bottles a day. One theory had it that people were buying to make sure they had enough wine on hand if things got even worse.

As we all sheltered in place, friends far and near set up online ‘happy hours’, where we were able to sip our favourite wines together and philosophise via Zoom or FaceTime or Skype. Every night, my husband and I gravitated towards comforting bottles that reminded us of life before lockdown – a sojourn in St-Emilion, dinner in a ristorante in Piedmont, our first trip to the Napa Valley. We toasted the winemakers, and were grateful to be together.

And all this made me ponder the many ways wine is woven into the lives and memories of so many people across the globe, who were doing the same thing. So for my last regular column for Decanter, I want to talk about why wine matters….

from Bloomberg News

Bollinger’s ‘Baby Brother’ Champagne Gives a Reason to Celebrate

July 29, 2020 — The middle of a pandemic is a pretty strange time to introduce a brand-new Champagne, even if you’re the powerful fizz brand associated with James Bond.

But hold on: The debut of the stunning Bollinger PN VZ15, which will arrive in the U.S. in September, turns out to be a prime time event for bubbly lovers.

It’s named for the project code written on barrels in the cellar: The “PN” stands for pinot noir, which is the only grape used in its production, and the “VZ” stands for Verzenay, a village with deep, chalky soil where about 50% of the grapes came from. The “15” is the vintage of the majority of the wine.

The oddly named, oddly timed release is the first edition of a series to be released every year. “Major Champagne houses rarely add a new wine to their permanent range,” says Peter Liem, author of Champagne: The Essential Guide to the Wines, Producers, and Terroirs of the Iconic Region. “Bollinger debuted its last one 12 years ago. Expectations were high.”

Spoiler alert: This all-pinot noir fizz is gorgeous, fresh, and vibrant, yet also rich and succulent. Intense aromas hinting of mint, flowers, and smoky nuts marry deep flavors of cool, red fruit and an almost salty, chalky finish. It’s listed at the eminently reasonable price of $120, but you can find it for as little as $100….

2016 Was the Perfect Year, at Least in Italy’s Barolo Wine Country

July 23, 2020 — The star grape in Italy’s northern Piedmont is nebbiolo, named for the misty fog that drifts over the hills at harvest time, when aromas of white truffles and fermenting wine fill the air. It’s the Italian equivalent to Burgundy’s pinot noir, as important to the region as cabernet is to Napa Valley.

Nebbiolo is a tricky grape, thin-skinned and difficult to vinify. To fully ripen, it requires a long growing season, which tames its famous tannins yet lets the wine age in deliciously complex ways. The haunting blend of licorice, cherry, and floral aromas along with its layers of complex flavors and elegant structure are key to the appeal of its most famous wine: Barolo, named after both a village and a part of the region.

In 2016, wine growers were anticipating a magnificent vintage before they picked a single grape. For starters, the weather was perfect throughout the growing season, says Jimmy Minutella of Renato Ratti, whose single-vineyard Barolo Rocche dell’Annuziata ($105) brims with a rose-petal bouquet and glides over the tongue like velvet….

Just 0.1% of U.S. Winemakers Are Black. Here’s How to Fix That

July 2, 2020 — Wine has always been one of our planet’s great social connectors, as well as a symbol of generosity, pleasure, and celebration.This spring, however, while the Covid-19 pandemic has reminded us how important human connection is, and the global Black Lives Matter protests have shown how far we have to go in creating a more equitable society, there’s renewed energy toward making the wine world more inclusive.

Although there are more than 8,000 wineries in the U.S., about one-tenth of 1% of the winemakers and brand owners are Black, estimates Phil Long, president of the Association of African-American Vintners and owner of the Longevity winery in the California Bay Area’s Livermore Valley. Which is why, Long says, “the real goal of our organization is promoting awareness—letting people know we exist, and we make great wine.

It’s true. Many of the wines are absolutely delicious, and range from big, bold reds with savory flavors to refreshing whites, as well as unusual, experimental sparkling wines made from hybrid grapes…

A Guide to Top Women Winemakers, Still Rare in the World of Grapes

July 1, 2020 — A few days before the pandemic lockdown began in New York, I’m at Balthazar restaurant, sipping wines and dishing gossip with a group of female winemakers from Bordeaux.

“My grandmother was not allowed into the cellar at our estate,” says Sylvie Courselle, who runs Château Thieuley with her sister Marie. “My father wept that he had no son to succeed him in making wine. We finally convinced him we, his daughters, could.” She rolls her eyes.

Historically, such places as Bordeaux, Chianti, Margaret River, and Napa were male bastions, where, with few exceptions, men owned the wineries, worked the vineyards, ruled the cellars, and sold the bottles.

In the 19th century and through most of the 20th, the death of a spouse was the way women could take over family wine companies. Trailblazing widows in Champagne such as Barbe-Nicole Ponsardin (Veuve Clicquot) and Lily Bollinger were wildly successful, revolutionizing the wines and making the region famous.

In the 21st century, some things have changed, but some have not. For sure, ambitious women today have taken on top roles with gusto, which means there are plenty of their great wines to celebrate this summer’s 100th anniversary of women’s right to vote in the U.S. But despite progress, the wine industry is still reckoning with gender inequality….

2019 Bordeaux Vintage Review: Perfectly Balanced, Rich, and Energetic

June 23, 2020 — Chateau Mouton Rothschild, $400 a bottle; Chateau Lafite Rothschild, $525; Chateau Pontet-Canet, $80; Chateau d’Issan $49: Prices for futures of 2019 Bordeaux wines have been rolling out fast and are still coming in.

The region’s en primeur campaign, which is the period when chateaux release prices for the most recent vintage and sell the wines while they are still aging in the barrel, is in full swing. And some of results are the best bargains since the 2008s, which were sold as futures the spring after Lehmann Brothers collapsed.

“Most people agree 2019 is a seriously good vintage,” says Christian Seely, the managing director of AXA Millesimes, which owns several Bordeaux chateaux. “In normal times, none of these wines would have been discounted. But you have to give people a reason to buy.”

Want to take a flyer on the futures game? You can find deals in every price category, from $20 to more than $500, whether you want to buy for sheer drinking pleasure or, hey, for investment.

After tasting some 125 samples shipped from Bordeaux, what’s impressed me most about the ones I rated best is their perfect balance, bright energy, and enticing floral aromas married with richness, fine soft tannins, and especially satiny textures….

Without Lavish Tastings, Bordeaux Sells Itself With Discounts, Zoom

At 9 a.m., I was sipping a barrel sample of 2019 Château Mouton Rothschild with Baron Philippe Sereys de Rothschild and managing director Philippe Dhalluin. Naturally, this was virtual: They were in Bordeaux; I was in the U.S.

The wine in my glass was real, though, and it was powerful, silky, and lush, “a rugby player in black tie,” as Dhalluin has described it

Barrels of it are sleeping quietly in the first growth château’s cellars and won’t be bottled and shipped until 2022. But like all top Bordeaux estates, Mouton sells the wine en primeur, as futures, the spring after harvest. Meaning now.

And now, in the face of a pandemic that blocks travel and has squashed commerce, the estates are grappling with how they can continue with the long-standing tradition—and what it will take, without it, for people to buy.

Ordinarily, 5,000 merchants fly in from around the globe in early April to taste barrel samples of the latest vintage, then decide what to offer to consumers as futures. Châteaux woo them with lavish dinners and elegant lunches, trying to build excitement that will translate into buying momentum. Hotels and restaurants are full and bustling.

Like other journalists, I end up driving madly from Saint-Estèphe to Saint-Emilion, sipping 400 to 500 wines at group tastings and individual estates to find those to recommend.

Not this year….

from YOUTUBE

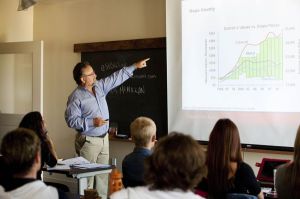

The Wider World of Napa: A Virtual Winetasting with Elin McCoy

June 11, 2020 — Like to join me for a virtual winetasting on YouTube? I recently gave an online master class for 67 Pall Mall, the pioneering London wine club that offers members a list of 4000-plus wines from 42 countries, and now is also offering virtual tastings via Zoom.

My subject? “The Wider World of Napa” (click for link) in which I explore the history of the valley through a mix of classic, pioneering producers such as Corison and Smith Madrone, a new generation of winemakers making waves such as Steve Matthiasson, Dan Petroski, and Massimo Di Costanzo, and a new project from well-known vintners, the Araujos, who sold their Eisele Vineyard to Francois Pinault, owner of Château Latour.

(It runs a little over an hour—there were lots of Q&A’s—so I suggest having a Napa white and red on hand to sample alongside.)

from BLOOMBERG NEWS

Don’t Panic, There Will Be Enough Whispering Angel Rosé This Summer

May 12, 2020 –This spring, we’re all craving symbols of normal life, and for wine lovers, that usually means bottles of chilled rosé. But wait. Will there be enough of it—or any at all—in this age of coronavirus?

Well, yes, but I have a few caveats.

Shipping is slower than usual, so some wines of 2019 vintage may not arrive for a while. The 25% tariff will push prices for faves from Provence slightly higher, and restaurants that once bought thousands of bottles of rosé to pour by the glass may, sadly, never open again.

I caught up by phone with Los Angeles chef Joachim Splichal of Patina restaurant, who has been making two delicious rosés at his Domaine de Cala estate in Provence since 2016….

How To Start a Whisky Collection

April 28, 2020 — A passionate whisky collector once told me that single malts are as intricate as jazz, with a texture like velvet. Who wouldn’t want to drink that?

The number of these aficionados is growing everywhere, from Manhattan to Ho Chi Minh City. “Whiskies,” says Chris Munro of Christie’s auction house, “offer as rich and complex a landscape as fine wine.”

If you like whisky, this is a good time for drinkers and investors, with more diverse bottles available than ever before—and I don’t mean the nine Game of Thrones bottlings. A new generation of collectors has embraced a boom in online whisky auctions, too, which offer thirsty aficionados around-the-clock bidding from where most of us are right now: home.

Sotheby’s Hong Kong, for example, is offering a stunning online sale of treasures through May 5. And in the midst of the novel coronavirus pandemic, whisky-focused bars and restaurants are selling off prize bottles to stay in business….

Boxed Wine and Vodka Made From CO2: The Green Future of Booze

April 15, 2020 — Amid the coronavirus pandemic, climate change still demands global attention, which is why a green movement is sweeping the wine and spirits world.

Did you know that synthetic bioluminescence from bacteria could make lighting in wineries more sustainable? Or that distillers can use solar power to create vodka out of thin air and water? These are among the surprising things I learned at a forum on wine and climate change at Vinexpo Paris in February, before social distancing became a way of life and air travel a memory.

At the three-day Living Soils Forum sponsored by industry giant Moët Hennessy, we sat on benches crafted from used barrel staves in a huge space enclosed by recyclable cork walls, sipping wine and listening to international climate scientists, winemakers, and environmental consultants discuss the multibillion-dollar wine industry’s future. (Full disclosure: I spoke on a panel about organic certification)….

Struggling Napa Wineries Offer Deep Discounts and Virtual Tastings

April 2, 2020 — Spring has arrived in idyllic Napa Valley. The buds emerging from dormant vines signal the beginning of a new vintage. The scene looks normal, except that vineyard workers are careful to stay 6 feet apart. Despite the global pandemic of Covid-19, there will still be grapes for this year’s cabernets.

That’s the good news.

But the novel coronavirus is having a huge impact on this tourism mecca, with wineries to restaurants to hotels suffering. The glitzy Auction Napa Valley, held annually since 1981, has been canceled for the first time.

“It’s the cloud of unknowing. I’m not even sure that I’ll have all the supplies needed for bottling in four months,” says winemaker Philippe Langner, owner of Hesperian winery on Atlas Peak. In 2017, Langner lost his house in the wine country fire.

The big worry is how the region’s almost 500 wineries will cope financially. Most depend heavily on visitors—3.9 million in 2018—to stop by their tasting rooms, snap up bottles, and join their wine clubs. California Governor Gavin Newsom ordered tasting rooms closed on March 20, though the wineries themselves are classified as essential businesses.

“Normally on a spring day, we’re bustling with guests. But now it’s a ghost town,” says Diana Hawkins, owner of Pope Valley Winery.

Many vintners have discovered that their insurance for business interruptions, meant to replace lost income to cover operating expenses, has a fine print clause that specifically excludes damage due to viruses and infections.

The spill out for wine lovers: good deals and rare wines directly from the source and, even better, the chance to support the wineries you love and forge a more personal connection with them….

Getting Great Wine Online Is Easier Than Ever

March 24, 2020 — Your favorite restaurants and bars may be closed, but online wine buying is booming—and already was before the Covid-19 coronavirus outbreak.

A January report from Rabobank, a global food and agribusiness bank, estimated that U.S. online sales reached $2.6 billion in 2019, growing 22% year on year. At the recent annual Impact Marketing Seminar, Rich Bergsund, chief executive officer of giant online retailer Wine.com, said the site pulled in $150 million in revenue in 2019.

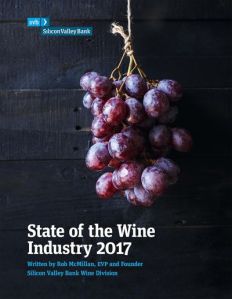

“No matter what happens, wine consumers won’t abstain,” wrote Rob McMillan, senior vice president of Silicon Valley Bank’s Wine Division, in a recent blog post. He predicts even higher wine sales are coming.

Gary Fisch, the CEO and owner of Gary’s Wine & Marketplace in New Jersey, can attest to that. In an email, he reported that sales during the week ending March 15 went up 62%. He also saw a 300% increase in local delivery and pickup orders.

And every bottle counts.

During social distancing, popping a cork while viewing the free operas the Metropolitan Opera is streaming (thank you, Met!) or gathering for a glass with friends over video chat virtual happy hour helps people in the industry keep going, whether it’s a small producer in Sonoma, Calif., France, or Italy; a retailer; or a slew of workers at a huge company such as LVMH….

Great Deals in California Wine Are Coming

March 5, 2020 — Good news is in rare supply these days, so wine lovers, drink this in: The quality California juice that’s been going into $25-plus name brand wines will start turning up in bottles that cost half the price for the next several years.

That’s the conclusion of several wine reports released in the past six weeks. Rob McMillan, founder of the wine division of Silicon Valley Bank, predicted in his annual State of the Wine Industry Report that wine lovers are about to enjoy the best retail values in 20 years…

Whiskey From Tibet and Organic Champagne Among Best New Booze

February 21, 2020 — Everyone loves Paris—even in February, when the City of Light is cold and gray, right?

That was the thinking behind holding this year’s VinExpo wine and spirits trade fair in Paris for the first time. Since 1981, the fair’s biannual home has been Bordeaux, but despite lavish chateau parties with fireworks, that version was losing market share to the no-nonsense annual German trade show, ProWein.

“Our goal in Paris,” says new Vinexpo chief executive Rodolphe Lameyse, “is to be the game changer—and the No. 1 wine and spirits marketplace in the world.”

This year’s three-day schmoozefest blended VinExpo with Wine Paris, another international exhibition, and last week drew some 30,000 international buyers to do deals, discover the latest trends, explore what’s new from 2,800 exhibitors from 20 countries, and delve into the topic of sustainability and climate change at Moët Hennessy’s three-day forum (more on that in a future column).

Low-Alcohol Wines That Taste Great

February 11, 2020 — Maybe you tried out dry January and it wasn’t for you, or your list of New Year’s resolutions still includes cutting back on alcohol—at least a bit—but you don’t want to swear off wine entirely. Believe me, you’re not alone.

The “no-and-low” wellness trend is well under way in the wine world, with the market for low- and no-alcohol drinks expected to grow 32% by 2022 from its 2018 status, according to John Gillespie of U.S. market-research firm Wine Opinions. The first trade show devoted to such products premieres in London in June.

“Drinking a bottle of 15%-alcohol wine is the equivalent of drinking a bottle of 12.5% wine—then downing three strong vodka tonics,” says importer Bartholomew Broadbent of Broadbent Selections. The difference between high and low is much bigger than you might think….

A Winemaker and a Billionaire Turn a Bay Area Island Into a Booze Destination

January 28, 2020 — Napa Valley whiz winemaker Dave Phinney thinks big. Very big.

Premium red-blend trendsetter? Check. Megahit brand builder for labels such as Orin Swift and the Prisoner? Ditto. Iconoclastic entrepreneur in a dozen wine regions around the globe? Yes.

So far, Phinney, 46, has made more than $150 million from selling those ventures. Now he’s taken on spirits with his Savage & Cooke Distillery, which led to a partnership with billionaire Gaylon Lawrence Jr. to transform the San Francisco Bay Area’s Mare Island into a hip booze destination and a sustainable community for 75,000 people.

“Designing a city from scratch is a little surreal,” he admits over lunch on a cold and sunny day at a Yonkers, N.Y., restaurant overlooking the Hudson River. “At heart I’m still a winemaker.”

Combining a laid-back Napa wine guy look—close-cropped beard, quilted vest, jeans, and checked shirt—with the intense focus of a business mogul on a tight schedule, Phinney dives into the backstory of how it all went down….

Eight Ways Wine Will Change in 2020

Illustration: Angie Wang

January 3, 2020 — What a decade this has been for wine—both good and bad.